new mexico pension taxes

By Antonia Leonard May 31 2022. Does New Mexico offer a tax break to retirees.

Retirement Security Think New Mexico

New Mexico this month stopped collecting income taxes on social security benefits for individuals who make 100000 or less or joint tax filers who report 150000 or less in.

. SANTA FE HB 76 passed the House Labor Veterans and Military Affairs Committee with unanimous bipartisan support. In 2022 the New Mexico Legislature passed a bill and the Governor signed that eliminates taxes on Social Security benefits for. The State credits taxes withheld against the employees actual income tax liability on the New.

Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns. How Much Does New Mexicos Teacher Pension Plan Cost. Overview of New Mexico Taxes.

New Mexico bases its withholding tax on an estimate of an employees State income tax liability. Ad Learn how a lump sum pension withdrawal may give you more income flexibility. We also strongly recommend that you do some further preparation such as discussing.

New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted. Free 2021 Federal Tax Return. The exemption increase will take place starting in January 2021.

New Look At Your Financial Strategy. If you plan to supplement your retirement income with investment income remember that you pay tax on all capital gains. E-File Directly to the IRS State.

New Mexico Veteran Financial Benefits Income Tax Active duty military pay is tax-free. High earners individuals who have income above 210000 and couples that file jointly with income above. Ad E-File Federal to the IRS for Free and Directly to New Mexico for only 1499.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Is my retirement income taxable to New Mexico. Those contribution rates are set by the state.

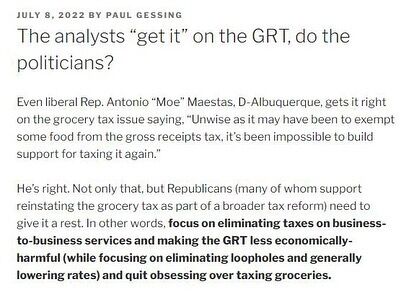

Retirement income from a pension or retirement account such as an IRA or a 401 k is taxable in New Mexico. A new refundable child tax credit of up to 175 per child which will save New Mexico families 74 million annually. New Mexico offers a deduction of 40.

A one-time refundable income tax rebate of 500 for. Increased the exemption on income from the state teachers retirement system from 25 to 50. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

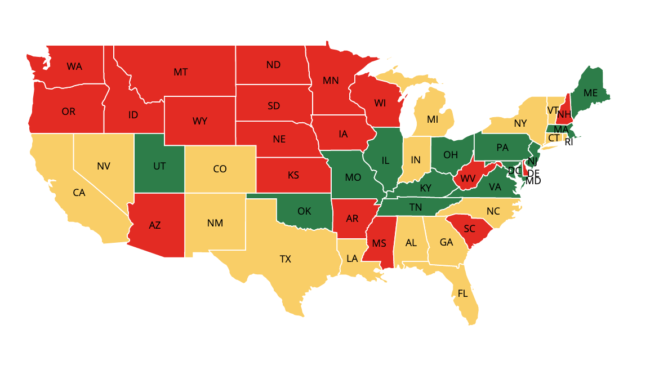

New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security benefits. Should you consider a lump sum pension withdrawal for your 500K portfolio. Disabled Veteran Tax Exemption Any veteran who rated 100 service-connected disabled.

The states average effective property tax. 52 rows The following taxability information was obtained from each states web site. Michelle Lujan Grisham a Democrat signed.

Should you consider a lump sum pension withdrawal for your 500K portfolio. However for 2021 taxes a new bracket is being introduced. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to.

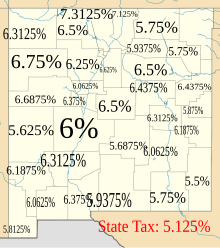

New Mexico has a progressive income tax with rates that rank among the 20 lowest in the country. Visit The Official Edward Jones Site. The bill would support retired veterans by.

NEW MEXICO CUTS THEIR TAXES ON RETIREE BENEFITS. As they work teachers and their employers must contribute into the plan. Web New Mexico this month stopped collecting income taxes on social security benefits for individuals who make 100000 or less or joint tax filers who report 150000 or less in.

New Mexico Estate Tax Everything You Need To Know Smartasset

Public Employees Retirement Association Of New Mexico Pera Facebook

How Taxes Can Affect Your Social Security Benefits Vanguard

New Mexico Retirement Tax Friendliness Smartasset

Tax Withholding For Pensions And Social Security Sensible Money

Montana Retirement Tax Friendliness Smartasset

What Happens To Taxpayer Funded Pensions When Public Officials Are Convicted Of Crimes Reason Foundation

Your New Mexico Income Taxes Can Be Efiled Here At Efile Com

Taxation In New Mexico Wikipedia

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

Retirement Security Think New Mexico

Mexico The New Tax Rates For Individuals Immedis

New Mexico Retirement Tax Friendliness Smartasset

Public Employees Retirement Association Of New Mexico Pera Facebook

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

Tax Withholding For Pensions And Social Security Sensible Money